Daily Analysis 01/09/2025

Latest Economic Insights

The dollar held near 97.8, its lowest level in a month, awaiting this week’s labor market data.

Gold is approaching a new record high of $3,480, supported by interest rate cut expectations and political uncertainty.

Oil falls: Brent crude at $67, WTI at $63.8 amid oversupply concerns.

A federal appeals court has ruled that Trump’s global tariffs are unlawful, allowing them to remain in place until October 14 pending the administration’s appeal.

Anticipation is mounting for this week’s US employment data (ADP and nonfarm payrolls) to determine the path of the Federal Reserve’s monetary policy.

Metaplanet increases its Bitcoin holdings to 20,000 BTC after a $108.6 million purchase.

Smart technical reports

How they work

A likely scenario for today is proposed, and the probability of this scenario occurring according to technical analysis may be between 60% and 75%.

If the first scenario fails, the probability of the second scenario occurring becomes between 60% and 75%.

The first scenario fails when the price reaches the level of the alternative scenario condition, and immediately the alternative scenario is activated and the prediction from the first scenario is cancelled.

These reports are not considered a substitute for a trader’s decision, but rather a tool to assist the follower in making their own decisions, as a reference based on the principles of classical technical analysis.

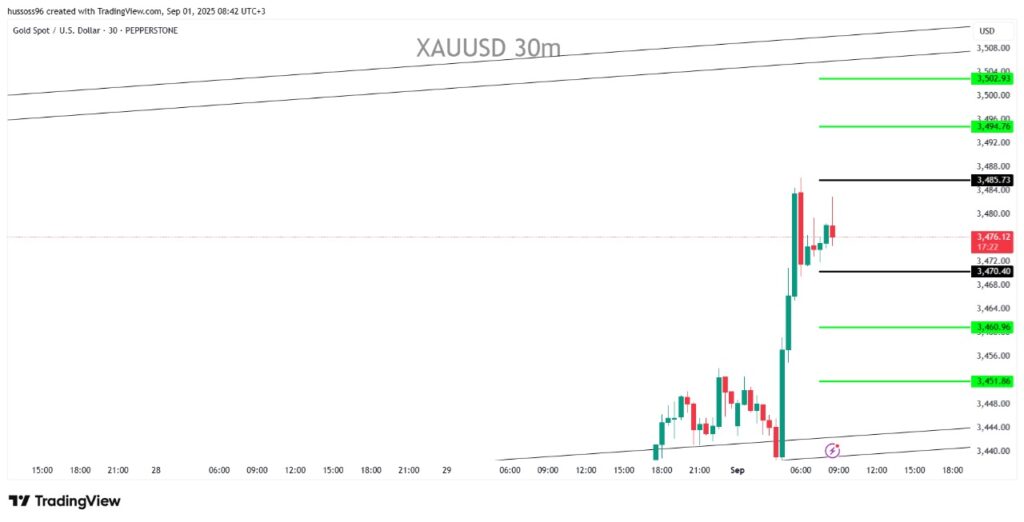

GOLD

General trend: Upward

Time interval: half an hour (30 minutes)

Current price: 3,476.12

Scenario 1: Buy gold with a breakout and stability above 3,485.73, targeting 3,494.76 and then 3,502.93.

Alternative scenario: Sell gold on a break and hold below 3,470.40, targeting 3,460.96 and then 3,451.86.

Comment: Gold is experiencing a strong upward momentum after rebounding from minor support, and a break above resistance could bolster a new upward wave.

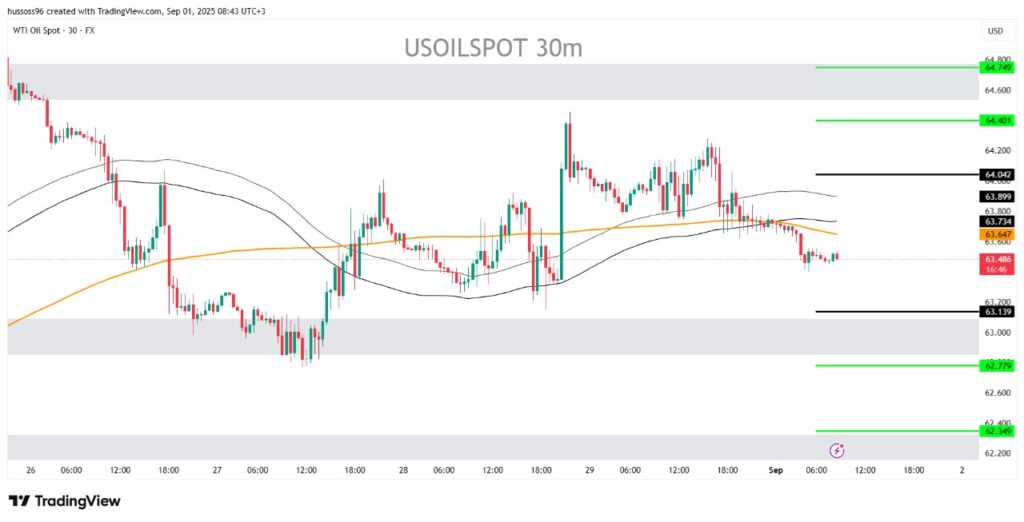

CRUDE OIL

General trend: bearish

Time interval: half an hour (30 minutes)

Current price: 63,486

Scenario 1: Buy oil with a break and hold above 64.042, targeting 64.401 and then 64.749.

Alternative scenario: Sell oil with a break and stability below 63.139, targeting 62.779 and then 62.349.

Comment: Oil is under selling pressure, but its proximity to a support area could open the way for a limited rebound if the level holds.

EURUSD

General trend: Upward

Time interval: half an hour (30 minutes)

Current price: 1.17131

Scenario 1: Buy the euro on a breakout and hold above 1.17234, targeting 1.17495 and then 1.17702.

Alternative scenario: Sell the euro on a break and hold below 1.16868, targeting 1.16637 and then 1.16435.

Comment: The euro is making strong gains near resistance levels, and a break above them could push it to new highs.

GBPUSD

General trend: Upward

Time interval: half an hour (30 minutes)

Current price: 1.35256

Scenario 1: Buy the pound with a break and hold above 1.35366, targeting 1.35543 and then 1.35742.

Alternative scenario: Sell the pound on a break and hold below 1.35075, targeting 1.34876 and then 1.34686.

Comment: The pound is holding above strong support and testing a critical resistance area, and the breakout opens the way for further upside.

NAS100

General trend: bearish

Time interval: half an hour (30 minutes)

Current price: 23,439.00

Scenario 1: Buy Nasdaq with a break and hold above 23,543.75, targeting 23,663.00 and then 23,770.75

Alternative scenario: Sell Nasdaq on breakout and hold below 23,386.75 with target at 23,282.00 then 23,173.75

Comment: Nasdaq is testing a minor support area, and a break below would reinforce selling pressure, while any rebound could restore buyers’ strength.

Economic Calendar

(Times are in GMT+3)

United States of America: Public Holiday – Labor Day.

Canada: Public Holiday – Labour Day.

Fundamental Analysis

The dollar index held steady at 97.8 on Monday, near a one-month low, as investors await a series of US labor market data due this week that could determine the Federal Reserve’s interest rate decision. Key reports include the August nonfarm payrolls data on Friday, along with unemployment figures, job openings, and the ADP private payrolls report.

Markets are currently pricing in an 88% chance of a 25 basis point rate cut in September, supported by recent inflation data (PCE) showing continued rising prices, increasing uncertainty about monetary policy.

On the trade front, a federal appeals court ruled that most of the tariffs Trump imposed under emergency powers were unlawful, but allowed them to remain in place until October 14, giving the administration time to appeal to the Supreme Court. These developments heightened political tensions and weighed on market confidence.

Gold climbed to $3,480 an ounce, approaching a new record high, as liquidity flowed into safe havens amid ongoing political and trade uncertainty and expectations of a Federal Reserve rate cut.

Meanwhile, West Texas Intermediate (WTI) crude futures fell to $63.8 per barrel, extending the previous session’s losses. This was affected by oversupply concerns as the OPEC+ meeting, expected to raise production, approaches, and the end of the summer driving season in the United States, which reduces fuel consumption.

Investors are also keeping an eye on the upcoming Shanghai Cooperation Organization summit, which will feature the leaders of China, Russia, and India, and which could impact global trade and energy relations.

Risk Disclaimer

Any information/articles/materials/content provided by WRPRO or displayed on its website is intended to be used solely for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although WRPRO has taken care to ensure that the content of such information is accurate, - it cannot be held responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and WRPRO accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: FX/CFDs are complex instruments and carry a high risk of losing money quickly due to leverage. You should consider whether you understand how FX/CFDs work and whether you can afford to take the high risk of losing your money.

You should make sure that, depending on your country of residence, you are allowed to trade with WRPRO products. Please ensure that you are familiar with the company’s risk disclosure.

en

en