Daily Analysis 06/10/2025

Latest Economic Insights

Top headlines

The dollar rises above 98 after last week’s losses as the US government shutdown continues.

Gold hits a new all-time high above $3,900 an ounce as safe-haven demand increases.

Oil rises more than 1% after OPEC+ decided to modestly increase production by only 137,000 barrels per day.

Bitcoin breaks the $124,000 barrier and is heading for a new short-term high.

The continued delay in US economic data due to the federal government shutdown further clouds the economic outlook.

Smart technical reports

How they work

A likely scenario for today is proposed, and the probability of this scenario occurring according to technical analysis may be between 60% and 75%.

If the first scenario fails, the probability of the second scenario occurring becomes between 60% and 75%.

The first scenario fails when the price reaches the level of the alternative scenario condition, and immediately the alternative scenario is activated and the prediction from the first scenario is cancelled.

These reports are not considered a substitute for a trader’s decision, but rather a tool to assist the follower in making their own decisions, as a reference based on the principles of classical technical analysis.

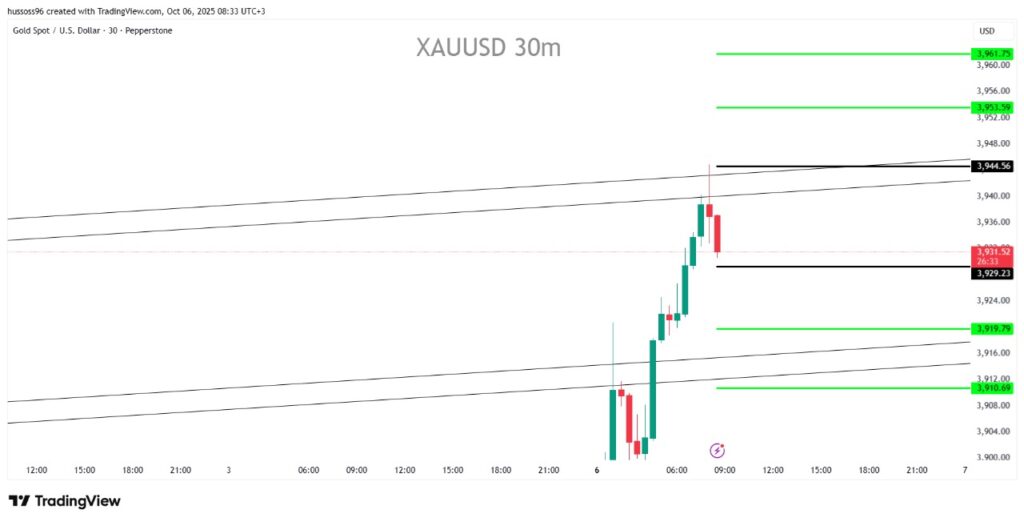

GOLD

General trend: Strong bullish after breaking through pivotal resistances

Time interval: half an hour (30 minutes)

Current price: 3,931

Scenario 1: Buy gold with a breakout and stability above 3,944, targeting 3,953 and then 3,961.

Alternative scenario: Sell gold on a break and hold below 3,929, targeting 3,919 and then 3,910.

Comment: The intraday trend remains bullish within a steep channel, but momentum indicators are beginning to show overbought conditions, and we may witness a temporary correction before continuing the upward trend.

CRUDE OIL

General trend: sideways, bullish

Time interval: half an hour (30 minutes)

Current price: 61.49

Scenario 1: Buy oil with a breakout and stability above 61.85, targeting 62.20 and then 62.55.

Alternative scenario: Sell oil with a break and hold below 60.94, targeting 60.58 and then 60.15.

Comment: Oil is moving within a narrow sideways range between clear support and resistance, and a break above 61.85 will be key to regaining positive momentum.

EURUSD

General trend: bearish in the short term

Time interval: half an hour (30 minutes)

Current price: 1.1715

Scenario 1: Sell the euro on a break and hold below 1.1700, targeting 1.1683 and then 1.1663.

Alternative scenario: Buy the euro with a breakout and hold above 1.1746, targeting 1.1769 and then 1.1789.

Comment: Selling momentum is currently dominant, but the pair may witness a limited correction before continuing its decline unless the 1.1746 resistance is breached.

GBPUSD

General trend: bearish

Time interval: half an hour (30 minutes)

Current price: 1.3441

Scenario 1: Sell the pound after breaking and holding below 1.3423, targeting 1.3403 and then 1.3384.

Alternative scenario: Buy the pound with a breakout and hold above 1.3456, targeting 1.3470 and then 1.3490.

Comment: The pair is fluctuating below the moving averages, suggesting continued weakness as long as 1.3456 is not firmly surpassed.

NAS100

General trend: Downward correction after a strong upward wave

Time interval: half an hour (30 minutes)

Current price: 25,089

Scenario 1: Sell Nasdaq with a break and hold below 24,995, targeting 24,890 and then 24,782

Alternative scenario: Buy Nasdaq with a breakout and hold above 25,152, targeting 25,272 and then 25,379

Comment: The index is facing moving resistance near 25,150, and only a break above it will confirm the return of upward momentum. Otherwise, we expect further corrective declines.

Economic Calendar

(Times are in GMT+3)

There are no major economic data releases scheduled for today due to the ongoing government shutdown in the United States.

Fundamental Analysis

The US dollar index rose above 98.0 on Monday, recovering from last week’s losses as markets remained cautious over the repercussions of the US government shutdown, which entered its second week after Congress failed to pass a funding agreement.

The shutdown has suspended federal programs and delayed the release of key economic reports, most notably the September nonfarm payrolls report, a key indicator in determining the future course of monetary policy. In the absence of this data, comments from Federal Reserve officials have become the most influential factor this week, with both Jerome Powell and Stephen Miller scheduled to speak in the coming days to clarify the bank’s position on upcoming rate cuts.

Markets are now pricing in two consecutive 25 basis point rate cuts this year (in October and December), driven by a slowing labor market and weak recent data, even as inflation remains moderate.

In currency markets, the dollar made strong gains against the Japanese yen, rising more than 1% after fiscal stimulus advocate Sanae Takaichi won the ruling party’s vote to become Japan’s new prime minister, raising expectations for continued accommodative monetary policy.

Gold jumped to $3,900 an ounce—an all-time high—driven by concerns about a prolonged government shutdown, increased demand for safe havens, and expectations of a US interest rate cut. ETF inflows and central bank buying by global banks also contributed to the bullish trend in the precious metal, which has risen more than 50% since the beginning of the year.

In energy markets, West Texas Intermediate crude rose to $61.70 and Brent crude to $65 per barrel after OPEC+ announced a limited production increase of only 137,000 barrels per day for November. Despite this slight increase, the organization left the door open to the possibility of reversing the increase if economic conditions change or global demand weakens.

Bitcoin continued its upward trajectory, surpassing $124,000, supported by a wave of institutional buying and growing optimism about the resurgence of interest in digital assets as a hedge against economic risks and financial uncertainty in the United States.

Risk Disclaimer

Any information/articles/materials/content provided by WRPRO or displayed on its website is intended to be used solely for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although WRPRO has taken care to ensure that the content of such information is accurate, - it cannot be held responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and WRPRO accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: FX/CFDs are complex instruments and carry a high risk of losing money quickly due to leverage. You should consider whether you understand how FX/CFDs work and whether you can afford to take the high risk of losing your money.

You should make sure that, depending on your country of residence, you are allowed to trade with WRPRO products. Please ensure that you are familiar with the company’s risk disclosure.

en

en