Daily Analysis 22/09/2025

Latest Economic Insights

Top headlines

The dollar index continues its gains for the fourth session, recording 97.7.

The Fed is hinting at two additional rate cuts this year, as gold hovers near $3,690 an ounce.

The European Union proposes the 19th package of sanctions against Russia, and oil rises to $67 for Brent and $62 for West Texas Intermediate.

Iraq increases oil exports, putting pressure on prices.

Bitcoin fails to break $117,750 and retreats towards potential support at $113,200.

Smart technical reports

How they work

A likely scenario for today is proposed, and the probability of this scenario occurring according to technical analysis may be between 60% and 75%.

If the first scenario fails, the probability of the second scenario occurring becomes between 60% and 75%.

The first scenario fails when the price reaches the level of the alternative scenario condition, and immediately the alternative scenario is activated and the prediction from the first scenario is cancelled.

These reports are not considered a substitute for a trader’s decision, but rather a tool to assist the follower in making their own decisions, as a reference based on the principles of classical technical analysis.

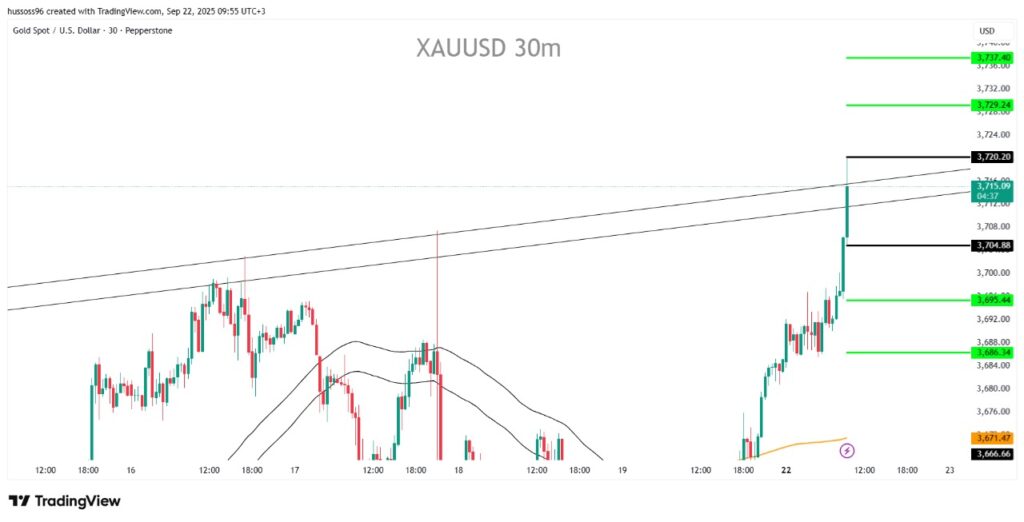

GOLD

General trend: Strong bullish

Time interval: Half an hour (30 minutes)

Current price: 3,715

Scenario 1: Buy gold with a breakout and stability above 3,720.20, targeting 3,729.24 and then 3,737.40.

Alternative scenario: Sell gold on a break and hold below 3,704.88, targeting 3,695.44 and then 3,686.34

Comment: Gold broke out higher and tested the upper channel line. Any further break above 3,720 could open the way for a new upside wave.

CRUDE OIL

General trend: bearish sideways

Time interval: half an hour (30 minutes)

Current price: 62.91

Scenario 1: Buy oil with a breakout and stability above 63.133, targeting 63.493 and then 63.841.

Alternative scenario: Sell oil with a break and hold below 62.231, targeting 61.871 and then 61.441.

Comment: Oil is within a range, and the next move depends on a breakout of one of the ends.

EURUSD

General trend: Bearish

Time interval: Half an hour (30 minutes)

Current price: 1.1742

Scenario 1: Buy the euro with a breakout and hold above 1.17639, targeting 1.17863 and then 1.18070.

Alternative scenario: Sell the euro on a break and hold below 1.17179, targeting 1.17005 and then 1.16803.

Comment: The euro is attempting an upward correction after a sharp decline, but the overall trend remains bearish.

GBPUSD

General trend: Bearish

Time interval: Half an hour (30 minutes)

Current price: 1.3473

Scenario 1: Buy the pound with a breakout and stability above 1.34869, targeting 1.35046 and then 1.35244.

Alternative scenario: Sell the pound after a break and stability below 1.34578, targeting 1.34379 and then 1.34189

Comment: The pound is trading in a narrow range after a strong downtrend, and touching the 1.3457 support level is important to determine the next direction.

NAS100

General trend: Up

Time interval: Half an hour (30 minutes)

Current price: 24,821

Scenario 1: Buy Nasdaq with a breakout and hold above 24,897.50, targeting 25,017.00 and then 25,124.50

Alternative scenario: Sell Nasdaq on break and hold below 24,755.63, targeting 24,643.87 and then 24,527.75

Comment: The Nasdaq is near strong resistance, and a break above 24,900 would push it to new record highs.

Economic Calendar

(Times are in GMT+3)

China: Key lending rate – 4.15

Fundamental Analysis

The dollar index rose above 97.7 on Monday, extending its gains for the fourth consecutive session, supported by investor expectations ahead of the release of a key US inflation report and speeches from several Federal Reserve officials this week.

Federal Reserve Chairman Jerome Powell and about nine other policymakers are scheduled to speak, and markets will closely monitor their tone. Notably, Stephen Miller, the new governor, will defend his opposition to last week’s decision, having favored a larger 50 basis point cut.

Markets are anticipating two additional 25 basis point rate cuts this year, in October and December, as the monetary easing cycle continues into next year. The Personal Consumption Expenditures (PCE) price index report, due on Friday, is likely to show relatively moderate inflation pressures, which could reinforce the easing path.

Gold benefited from these expectations, rising to $3,690 per ounce, also supported by geopolitical tensions, economic risks related to Trump’s tariffs, and strong demand from central banks and investment funds.

On the energy front, West Texas Intermediate crude rose to $62.6 and Brent to $67, benefiting from the prospect of the European Union imposing new sanctions on Russia, including a ban on Russian liquefied natural gas imports by January 2027, in addition to targeting more than 118 foreign vessels and companies supporting Russian oil trade. However, increased Iraqi crude oil exports capped the gains, keeping supply pressures intact.

In the crypto market, Bitcoin failed to maintain its gains above $117,750, retreating towards a key support level at $113,200, reflecting weak buying momentum despite recent attempts to rally.

Risk Disclaimer

Any information/articles/materials/content provided by WRPRO or displayed on its website is intended to be used solely for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although WRPRO has taken care to ensure that the content of such information is accurate, - it cannot be held responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and WRPRO accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: FX/CFDs are complex instruments and carry a high risk of losing money quickly due to leverage. You should consider whether you understand how FX/CFDs work and whether you can afford to take the high risk of losing your money.

You should make sure that, depending on your country of residence, you are allowed to trade with WRPRO products. Please ensure that you are familiar with the company’s risk disclosure.

en

en