Daily Analysis 22/12/2025

Latest Economic Insights

Top headlines:

The U.S. Dollar Index held steady at 98.6 on Monday, following marginal gains recorded last week.

Market participants are currently pricing in two additional interest rate cuts by the Federal Reserve in the coming year.

Prices of precious metals have surged by more than 60% year to date and are on course to post their strongest annual performance since 1979.

Crude oil prices advanced amid heightened geopolitical tensions.

Smart technical reports

How they work

A likely scenario for today is proposed, and the probability of this scenario occurring according to technical analysis may be between 60% and 75%.

If the first scenario fails, the probability of the second scenario occurring becomes between 60% and 75%.

The first scenario fails when the price reaches the level of the alternative scenario condition, and immediately the alternative scenario is activated and the prediction from the first scenario is cancelled.

These reports are not considered a substitute for a trader’s decision, but rather a tool to assist the follower in making their own decisions, as a reference based on the principles of classical technical analysis.

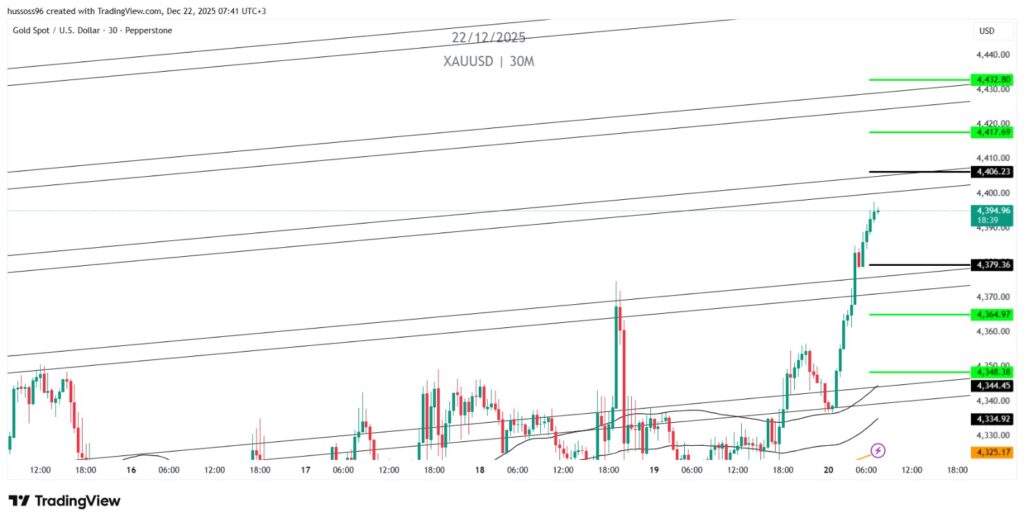

GOLD

Trend: Uptrend within an ascending channel

Timeframe: 30 minutes

Current Price: 4,394.96

Primary Scenario (Bullish) : Buy on a breakout above 4,406.23

Targets: 4,417.69 first, then 4,432.80

Alternative Scenario (Bearish) :Sell on a break below 4,379.36

Targets: 4,364.97 first, then 4,348.38

Comment: Gold is showing strong momentum within the ascending channel. Any downside move should be considered corrective as long as price remains above 4,348

CRUDE OIL

Trend: Corrective uptrend

Timeframe: 30 minutes

Current Price: 56.961

Primary Scenario (Bullish): Buy on a breakout above 57.147

Targets: 57.506 first, then 57.854

Alternative Scenario (Bearish): Sell on a break below 56.648

Targets: 56.294 first, then 55.858

Comment: Crude oil has successfully bounced off its recent low, but it remains below key resistance levels.

EURUSD

Trend: Corrective downtrend

Timeframe: 30 minutes

Current Price: 1.17192

Primary Scenario (Bearish): Sell on a break below 1.17026

Targets: 1.16851 first, then 1.16650

Alternative Scenario (Bullish): Buy on a breakout above 1.17338

Targets: 1.17557 first, then 1.17764

Comment: The overall trend remains weak below the moving averages. Any long positions should be considered only after a clear breakout.

GBPUSD

Trend: Sideways with bullish bias

Timeframe: 30 minutes

Current Price: 1.33988

Primary Scenario (Bullish): Buy on a breakout above 1.34097

Targets: 1.34273 first, then 1.34472

Alternative Scenario (Bearish): Sell on a break below 1.33856

Targets: 1.33607 first, then 1.33417

Comment: Price remains supported above the moving averages. A break above 1.341 would confirm continuation of the positive momentum.

NAS100

Trend: Uptrend

Timeframe: 30 minutes

Current Price: 25,679.50

Primary Scenario (Bullish): Buy on a breakout above 25,746.00

Targets: 25,865.25 first, then 25,973.00

Alternative Scenario (Bearish): Sell on a break below 25,589.00

Targets: 25,484.25 first, then 25,381.88

Comment: Upward momentum is evident following the strong breakout. Any pullback toward 25,589 should be considered corrective as long as price remains above this support.

Economic Calendar

(Times are in GMT+3)

From the United Kingdom:

Gross Domestic Product (GDP) YoY / Q3 – 10:00

From the United States:

Core Personal Consumption Expenditures (PCE) Price Index YoY / October – 18:00

Core Personal Consumption Expenditures (PCE) Price Index MoM / October – 18:00

Fundamental Analysis

The U.S. Dollar Index remained stable at 98.6 on Monday after posting modest gains last week, with trading conditions expected to be subdued during the holiday-shortened week due to the Christmas period.

•

Market participants are likely to focus on the advance estimate of third-quarter gross domestic product (GDP), due for release on Thursday. The data should offer key insights into underlying economic conditions and help refine expectations for the timing and pace of future Federal Reserve policy adjustments.

•

Markets are currently pricing in two additional interest rate cuts by the Federal Reserve next year, following weaker-than-expected U.S. inflation data released last week.

•

On the global front, traders continue to monitor developments in the Japanese yen after Bank of Japan Governor Kazuo Ueda reiterated a cautious policy stance in the aftermath of last week’s interest rate increase.

Gold prices reached a fresh record high above $4,380 per ounce on Monday, driven by growing expectations of additional U.S. monetary policy easing and heightened geopolitical risks.

•

The advance has been supported by robust central bank purchases and continued inflows into gold-backed exchange-traded funds (ETFs).

Bitcoin attempted to initiate a fresh upward move but encountered resistance near the $89,250 level.

•

The cryptocurrency is currently consolidating below $89,000 and remains vulnerable to a potential downside correction.

•

West Texas Intermediate (WTI) crude oil futures climbed to $56.90 per barrel on Monday, building on Friday’s gains, as rising geopolitical tensions fueled concerns over potential supply disruptions.

•

Reports indicate that the United States is tracking another vessel near Venezuelan waters, intensifying the pressure from President Trump’s ongoing blockade of the country. Washington has already seized two oil tankers this month, the most recent occurring on Saturday, amid a significant U.S. military presence in the region.

•

In parallel, Ukraine reportedly targeted a Russian oil tanker in the Mediterranean Sea for the first time, following prior attacks on Lukoil-operated facilities in the Caspian Sea.

•

These incidents unfold amid continued diplomatic efforts to resolve the conflict between the two nations. U.S. and Ukrainian officials described talks in Miami on Sunday as “productive and constructive,” though no substantive breakthrough was reported.

•

Despite these geopolitical risks supporting near-term oil prices, crude remains on track for a year-to-date decline, pressured by expectations of a persistent global supply surplus.

Risk Disclaimer

Any information/articles/materials/content provided by WRPRO or displayed on its website is intended to be used solely for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although WRPRO has taken care to ensure that the content of such information is accurate, - it cannot be held responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and WRPRO accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: FX/CFDs are complex instruments and carry a high risk of losing money quickly due to leverage. You should consider whether you understand how FX/CFDs work and whether you can afford to take the high risk of losing your money.

You should make sure that, depending on your country of residence, you are allowed to trade with WRPRO products. Please ensure that you are familiar with the company’s risk disclosure.

en

en