Daily Analysis 09/01/2026

Latest Economic Insights

Top headlines:

The U.S. dollar continues its gains for the fourth consecutive session ahead of the release of the U.S. jobs report.

Gold steadies near weekly highs as investors await employment data and geopolitical risks escalate.

Oil extends its gains and is heading for a third weekly rise, supported by global tensions.

Bitcoin struggles to hold the $90,000 level amid a clear divide in market sentiment.

Smart technical reports

How they work

A likely scenario for today is proposed, and the probability of this scenario occurring according to technical analysis may be between 60% and 75%.

If the first scenario fails, the probability of the second scenario occurring becomes between 60% and 75%.

The first scenario fails when the price reaches the level of the alternative scenario condition, and immediately the alternative scenario is activated and the prediction from the first scenario is cancelled.

These reports are not considered a substitute for a trader’s decision, but rather a tool to assist the follower in making their own decisions, as a reference based on the principles of classical technical analysis.

GOLD

Trend: Bullish within an ascending channel

Timeframe: 30 minutes

Current Price: 4,470.34

Primary Scenario – Buy on Breakout above 4,481.41

Targets: 4,492.87, then 4,507.98

Alternative Scenario – Sell on Breakdown below 4,454.54

Targets: 4,440.15, then 4,423.56

Note: Gold continues to trade firmly within its ascending channel. A sustained break below 4,454 would undermine the bullish momentum and shift the short-term bias toward the downside.

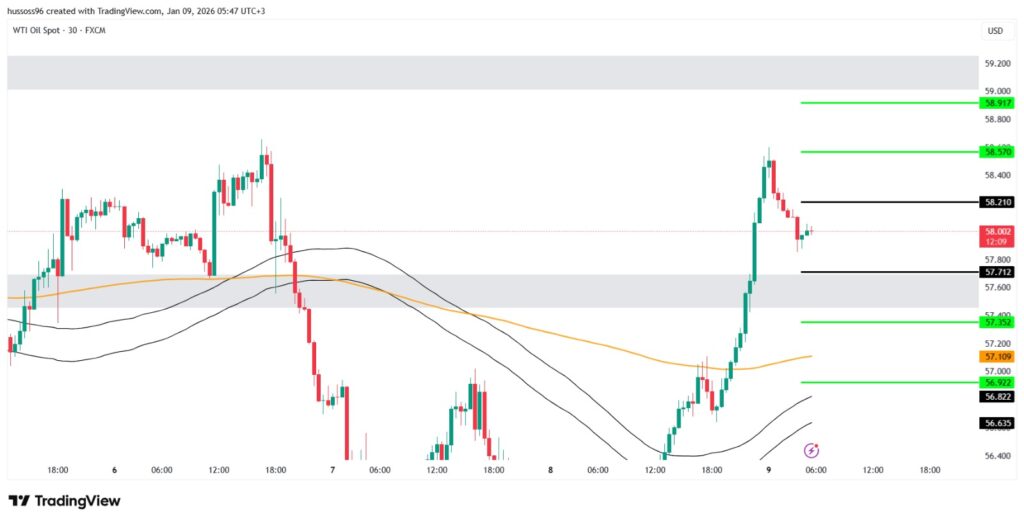

CRUDE OIL

Trend: Corrective bullish bias

Timeframe: 30 minutes

Current Price: 58.002

Primary Scenario – Buy on Breakout above 58.210

Targets: 58.570, then 58.917

Alternative Scenario – Sell on Breakdown below 57.712

Targets: 57.352, then 56.922

Note: The recent rebound has been strong, but price is now facing near-term resistance. A confirmed break above 58.21 is required to validate continuation of the upward move.

EURUSD

Trend: Bearish

Timeframe: 30 minutes

Current Price: 1.16531

Primary Scenario – Buy on Breakout above 1.16895

Targets: 1.16941, then 1.17147

Alternative Scenario – Sell on Breakdown below 1.16409

Targets: 1.16235, then 1.16033

Note: Selling pressure remains dominant, and a sustained break below 1.164 would reinforce bearish momentum and support further downside extension.

GBPUSD

Trend: Bearish

Timeframe: 30 minutes

Current Price: 1.34323

Primary Scenario – Buy on Breakout above 1.34650

Targets: 1.34849, then 1.34949

Alternative Scenario – Sell on Breakdown below 1.34182

Targets: 1.33983, then 1.33793

Note: The overall trend remains negative, and any upward move should be considered corrective as long as price stays below 1.34650.

NAS100

Trend: Sideways with bearish bias

Timeframe: 30 minutes

Current Price: 25,675.50

Primary Scenario – Buy on Breakout above 25,745.47

Targets: 25,869.25, then 25,977.00

Alternative Scenario – Sell on Breakdown below 25,593.00

Targets: 25,488.25, then 25,380.25

Note: Price is trading below the moving averages, and selling pressure remains dominant unless a sustained break above 25,745 occurs.

Economic Calendar

(Times are in GMT+3)

From the United States:

Average Hourly Earnings (MoM) – December | 16:30

Non-Farm Payrolls (NFP) – December | 16:30

Unemployment Rate – December | 16:30

Fundamental Analysis

The U.S. Dollar and Monetary Policy

•

The U.S. Dollar Index advanced toward the 99 level on Friday, recording its fourth consecutive session of gains and reaching its highest point in nearly a month, as markets positioned ahead of the release of the highly anticipated U.S. December employment report — the key macroeconomic event of the week.

•

Data published on Thursday showed a modest uptick in initial jobless claims to 208,000, while announced corporate layoffs declined to 35,553 in December, the lowest reading since July 2024. These figures underscore the continued resilience of the U.S. labor market despite earlier indications of economic cooling.

•

Financial markets are currently assigning nearly a 90% probability that the Federal Reserve will maintain its policy rate at the January meeting, while still pricing in two or more rate cuts later in 2026.

•

Meanwhile, investors remain attentive to a potential ruling by the U.S. Supreme Court on the legality of tariffs imposed during the Trump administration, given the ruling’s potential implications for trade flows and inflation dynamics.

•

In currency markets, the dollar recorded its strongest weekly performance against the euro, supported by growing evidence of easing inflationary pressures in the euro area — further widening the divergence in monetary policy expectations between the Federal Reserve and the European Central Bank.

Gold & Silver

•

Gold prices stabilized near $4,470 per ounce, retaining most of their recent gains as investors await the release of the pivotal U.S. employment data.

•

The precious metal remains on track to post weekly gains of around 3%, supported by several key factors:

Rising geopolitical risks, particularly in the Middle East and Venezuela.

Comments from President Trump signaling a strong response to any potential Iranian aggression.

Ongoing tensions linked to Venezuela, alongside renewed rhetoric regarding Greenland.

Sustained central bank demand, with China extending its gold purchases for a fourteenth consecutive month.

•

Despite the strength of the U.S. dollar, gold has shown notable resilience, underpinned by persistent safe-haven flows amid heightened global uncertainty.

Oil

•

Oil prices extended their advance, with Brent crude trading near $62 per barrel and West Texas Intermediate hovering around $58 per barrel.

•

Prices are on course to record a third consecutive weekly gain, underpinned by escalating geopolitical tensions, including:

Warnings from President Trump to Iran, signaling a “strong” response in the event of further escalation.

Reports that Trump has endorsed legislation imposing tougher sanctions on Russia, targeting countries purchasing Russian oil at discounted prices.

Continued U.S. actions against Venezuela, including the seizure of oil tankers — one of which reportedly flies the Russian flag.

•

These developments reflect intensified U.S. efforts to influence global energy flows, although persistent concerns over excess supply continue to cap upside potential in the medium term.

Bitcoin:

•

Bitcoin continues to struggle to maintain levels above $90,000, following a sharp pullback from the key resistance zone near $94,000.

•

Market sentiment is currently clearly divided:

One camp believes that Bitcoin is entering a deeper corrective phase.

Another views the recent decline as a healthy consolidation, resetting momentum ahead of a potential renewed upside attempt.

•

The current price action reflects a period of heightened uncertainty and elevated volatility, with a visible tug-of-war between buyers and sellers over the short-term directional bias.

Risk Disclaimer

Any information/articles/materials/content provided by WRPRO or displayed on its website is intended to be used solely for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although WRPRO has taken care to ensure that the content of such information is accurate, - it cannot be held responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and WRPRO accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: FX/CFDs are complex instruments and carry a high risk of losing money quickly due to leverage. You should consider whether you understand how FX/CFDs work and whether you can afford to take the high risk of losing your money.

You should make sure that, depending on your country of residence, you are allowed to trade with WRPRO products. Please ensure that you are familiar with the company’s risk disclosure.

en

en